by Paige Wickline, Finance Director

Our Fiscal Year 2022 (FY22) runs from July 5, 2021 through July 3, 2022. Each spring, management prepares an operating and capital budget for the next fiscal year that is presented to the Finance Committee for input and then forwarded to our Board of Directors for final approval.

The economic uncertainty we experienced during the pandemic has continued to influence how we plan for the future and develop our goals and budget. While many grocers experienced substantial sales growth during the pandemic, our Co-op experienced negative sales growth, reduced earnings on those sales along with an increase in expenses. Our sales growth was impacted by our decision to prioritize the safety of our employees and shoppers by limiting the number of shoppers allowed in each store significantly below the maximum allowed per Dane County Public Health mandates when they were in place.

Budget Focus

Our FY22 budget goal is to work toward obtaining financial sustainability while continuing our journey of understanding of what it means to become more equitable, inclusive, and diverse. This will be accomplished with a focus on customer service, maintaining sales, and increasing the percent of revenue we have left over after we pay for the cost of goods we sell.

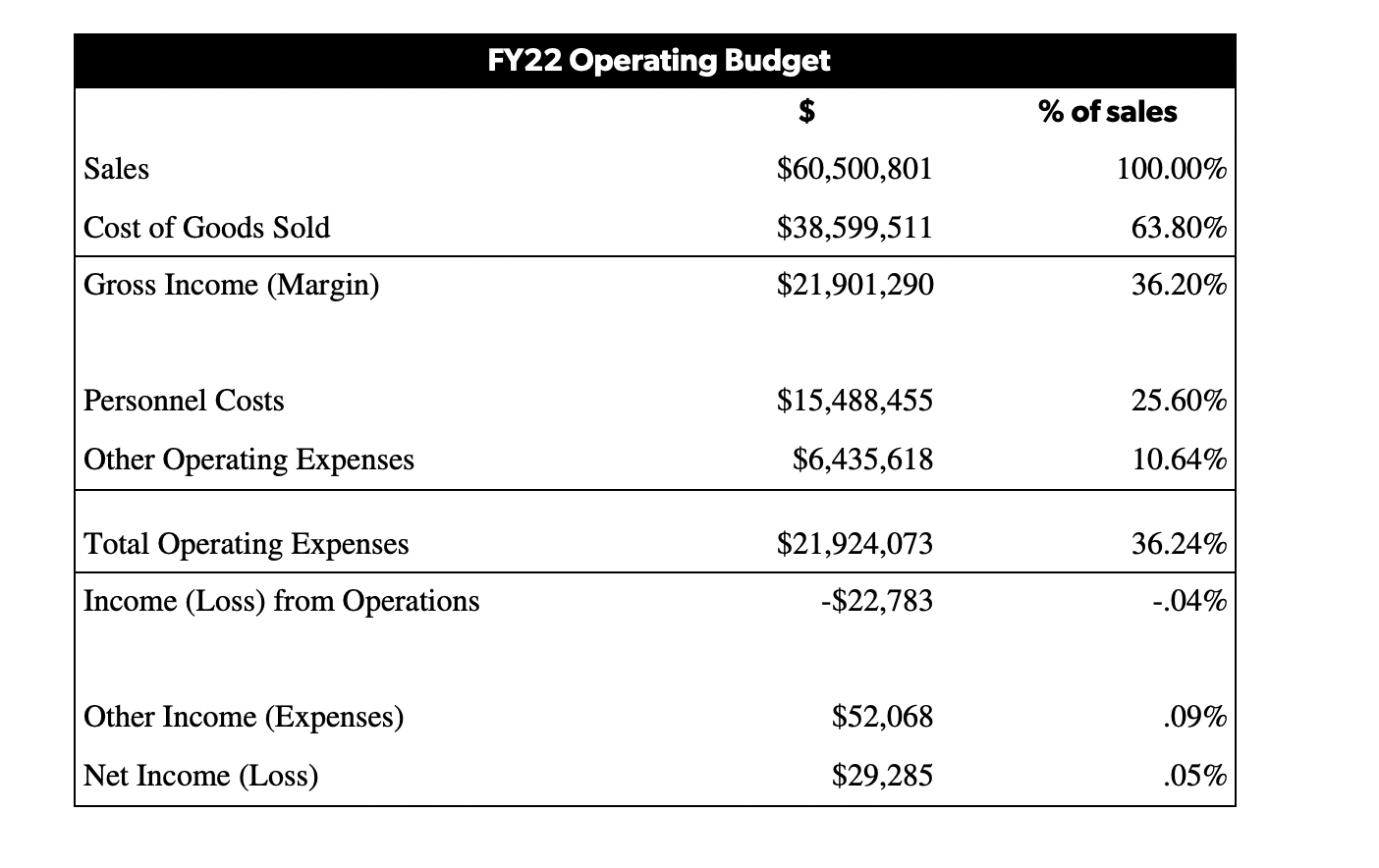

It will take us multiple years to fully recover financially from the impact the pandemic has had on our Co-op. This year is a transition back to healthy operating income levels after two years of operating losses. We are budgeting for a small loss from operations and a small positive net income of .05% after we include the expenses and income not directly related to grocery sales.

Net income of 1%-2% of sales is the retail grocery industry standard for financial sustainability. FY22 will transition us from the large operating loss of almost $1 million in FY21 to net income in the range of 1-2% as a percent of sales in FY23.

Total Sales. The FY22 sales projections for our Co-op include modest sales growth of just over 3.4% above pre-COVID levels. We anticipate a little more than half of the sales increase to be the result of selling a higher quantity of items to our shoppers and the remainder of the increase due to inflation and paying a higher wholesale price for items than pre-COVID. We anticipate an increase in the number of transactions over the previous year but not back to pre-COVID levels, while the average dollar amount of each transaction (basket size) will trend down from the higher levels experienced during COVID but still retain some of the increase.

Gross Income (Margin). Gross margin refers to the percent of sales remaining after subtracting the cost of goods sold. Gross margin dollars are the funds used to pay for our operations. Our gross margin of 36.2% is up slightly from the previous year’s budget. To achieve this we will continue to focus on monitoring our sales mix and making targeted pricing changes where necessary.

Personnel. Personnel expenses include labor hours and benefits. These costs are budgeted to be 25.60% of sales, which is slightly lower than

pre-COVID levels.

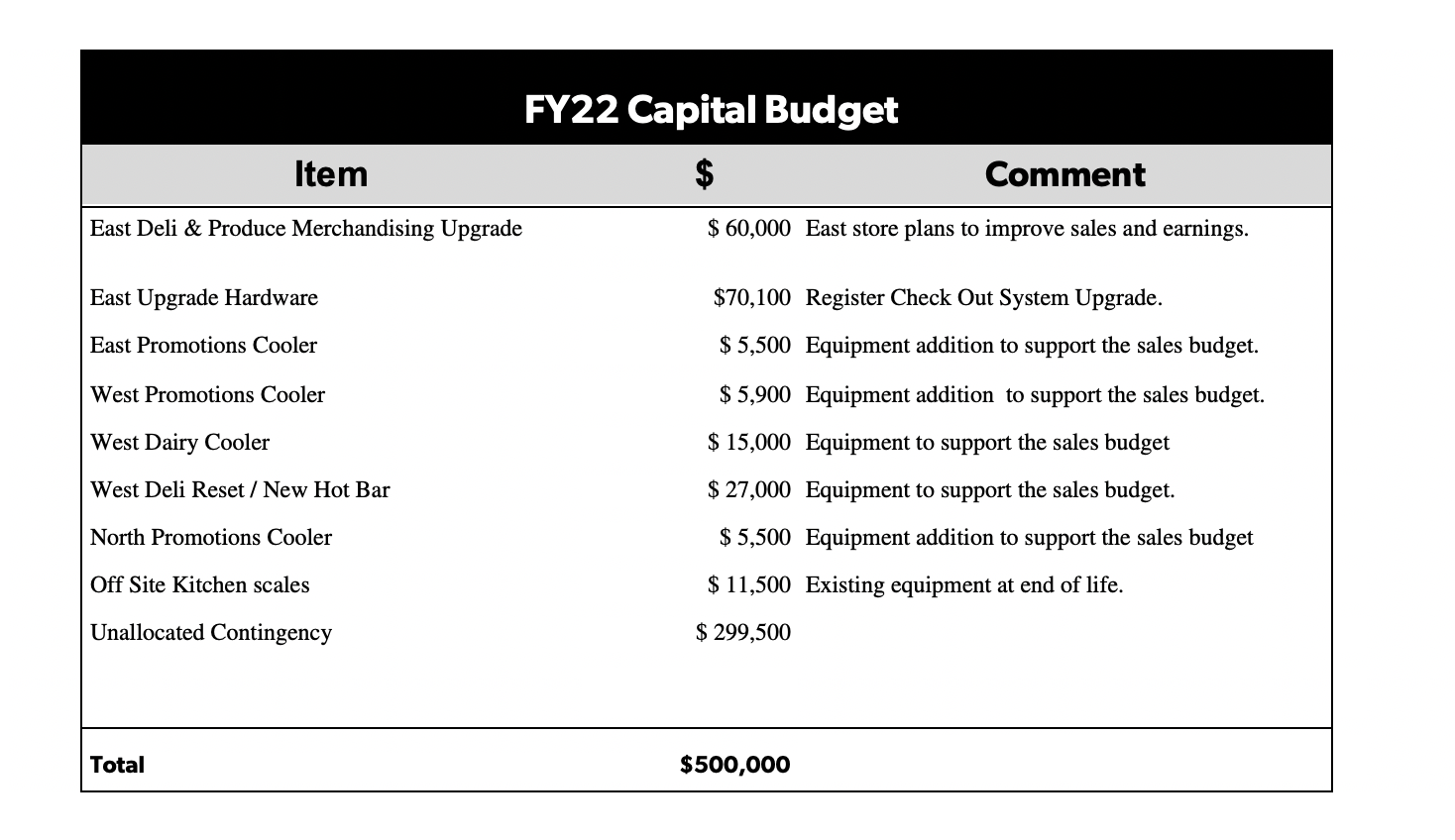

Capital Budget. The FY22 capital budget is $500,000, the same amount approved for FY21. The budget includes a small list of items to support our sales goals, improve labor efficiency, and keep our point of sale/register system up-to-date. The remainder of the budget is contingency funding to cover the replacement of any critical equipment that may break down and that we are unable to repair.

We thank you for your ongoing patronage and support. If you have any questions regarding the FY22 budget, feel free to email me at p.wickline@willystreet.coop.