by Paige Wickline, Finance Director

Budgeting During A Pandemic

We developed our budget in the spring of 2020 when the uncertainty of COVID-19 was still fresh and we were hopeful for winter holidays spent with family and friends. We looked forward to FY21 (a 53-week year running from June 29, 2020 through July 4, 2021) with cautious optimism. Our budget was approved in June 2020 by our Board of Directors.

FY21 Budget Focus

Our budget assumptions were based on the knowledge we had of the future at the time and included an estimate of the impact of global and national events on our local co-op. These included COVID-19, an economic downturn, ongoing supply chain challenges, a contentious presidential election and ongoing social unrest.

Due to these events, we framed our strategic budget focus as a balance between financial sustainability and the safety of staff and customers while bringing equity, inclusion, and diversity to the forefront of all that we do.

To accomplish this we included plans to expand and fine-tune our catalog of online shopping options. We also contracted with Step Up: Equity Matters, a local consulting firm, to assist us with becoming a more equitable organization.

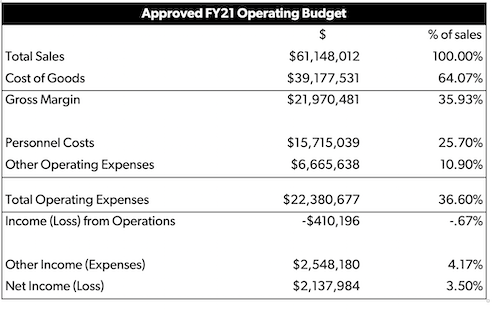

Our operating budget shows a loss from operations of $-410,196 and other income of $2,548,180, bringing us to net income of $2,137,984. The other income includes the accounting entry to record the forgiveness of the $2.5 Million personal paycheck protection (PPP) loan we received in April 2020.

PPP Loan

The PPP loan was reported as debt on our FY20 year-end financial statements per generally accepted accounting principles (GAAP). Our FY21 budget reflects 100% of the loan being forgiven and recorded as other income. We plan to file for forgiveness by the end of the calendar year and anticipate we will meet the criteria for most of the loan to be forgiven.

Total Sales

The FY21 sales projections for our three retail sites and online ordering were based on the assumption that COVID-19 would continue to suppress sales in the first quarter and then they would slowly increase back to pre-COVID levels, ending the year with 4% sales growth.

Gross Margin

Gross margin refers to the percent of sales remaining after subtracting the cost of goods sold. Gross margin dollars are the funds used to pay for our operations. Our gross margin of 35.93% is down slightly from the previous year. This reduction is from changes in our sales mix. Shopping habits have changed dramatically since COVID-19, with a greater percentage of our sales coming from grocery sub-departments that have a lower margin.

Personnel

Personnel expenses include labor hours and benefits. These costs are budgeted to be 25.70% of sales, which is slightly lower than the previous year.

Capital Budget

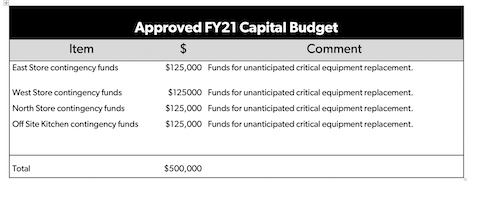

The FY20 approved capital budget is $500,000. These funds were approved to be used to replace any critical/essential equipment that may need to be replaced or is needed to expand online shopping. All optional upgrades have been put on hold until after the pandemic.

We are in the middle of the second quarter of FY21 and the challenges we face have only increased, as they have for most businesses across the nation. Our current projections show our operating loss to be closer to $1 Million which will reduce our net income to around $1.5 Million.

Although our sales are notably below budget at this point—primarily due to our limits on customer capacity for almost half of this year—we are working on ways to provide Owners with more products they want while increasing convenience in getting them.

We continue to work closely with our Finance committee and Board of Directors to keep them apprised of our operating results and our updated financial projections.

If you have any questions regarding the FY21 budget, feel free to email me at p.wickline@willystreet.coop.